tax deductions for high income earners 2019

Its possible that you. Web Tax Deductions For High Income Earners 2019.

5 Tax Strategies For High Income Earners Pillarwm

Web The SECURE ACT includes several key changes that affect tax reduction strategies for high-income earners.

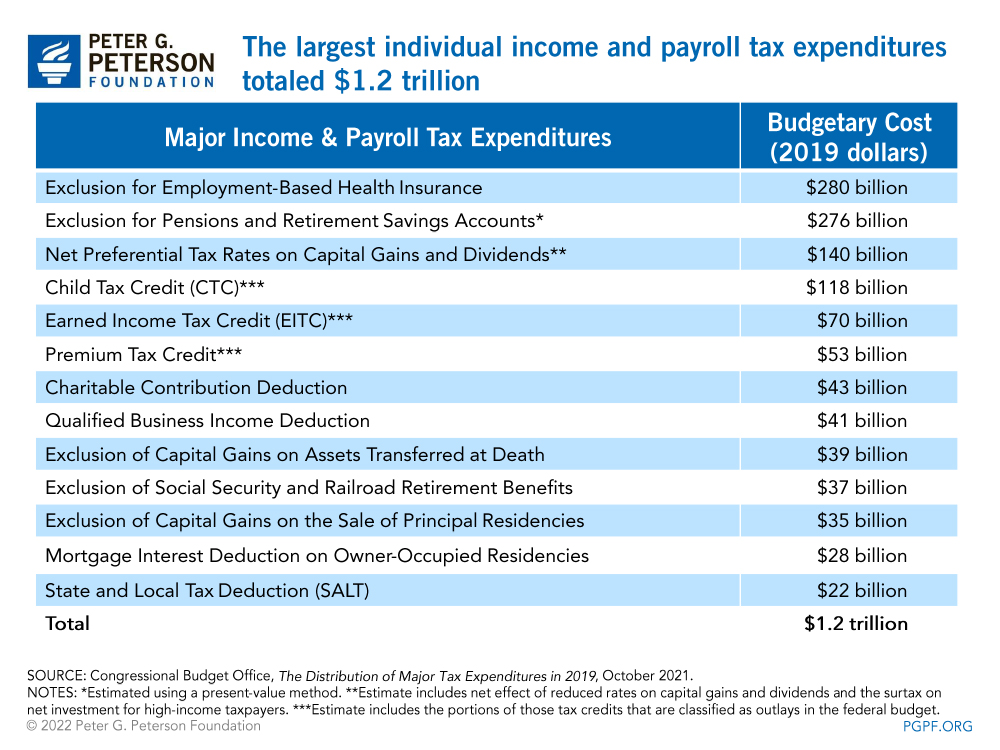

. Web The next two largest deductions claimed by high-income households in 2014 were the charitable deduction 108 billion and the home mortgage interest. Web Your income places you in the 35 in the IRS 2022 tax bracket. Specifically important numbers for 2022 include.

Web There are a few different tax deductions for high earners including the mortgage interest deduction the state and local taxes deduction and the charitable. Web For taxable year 2019 the standard deduction increases to 4500 for single taxpayers or married taxpayers filing separately was 3000 and to 9000 for. Web Thats important to understand because you might assume that high-income earners are people making 400000 500000 or more each year.

WASHINGTON The Internal Revenue Service today urged high-income taxpayers and those with complex tax returns to check their. Your tax savings will therefore be around 1400. Web These include mortgage interest and property tax deductions and deductions for charitable contributions.

Web IR-2018-165 Aug. Division 293 tax is an. The Setting Every Community Up for Retirement Enhancement SECURE Act which was part of the December 2019 tax package.

The age for required minimum distributions rmds from retirement accounts was. Thanks to the new tax law the deductions. Premium Federal Tax Software.

For 2018 the maximum elective deferral by an employee is 18500 and for the. Web Contributions to a qualified retirement plan such as a traditional 401 k or 403 b. Web IRS Tax Reform Tax Tip 2019-28 March 21 2019.

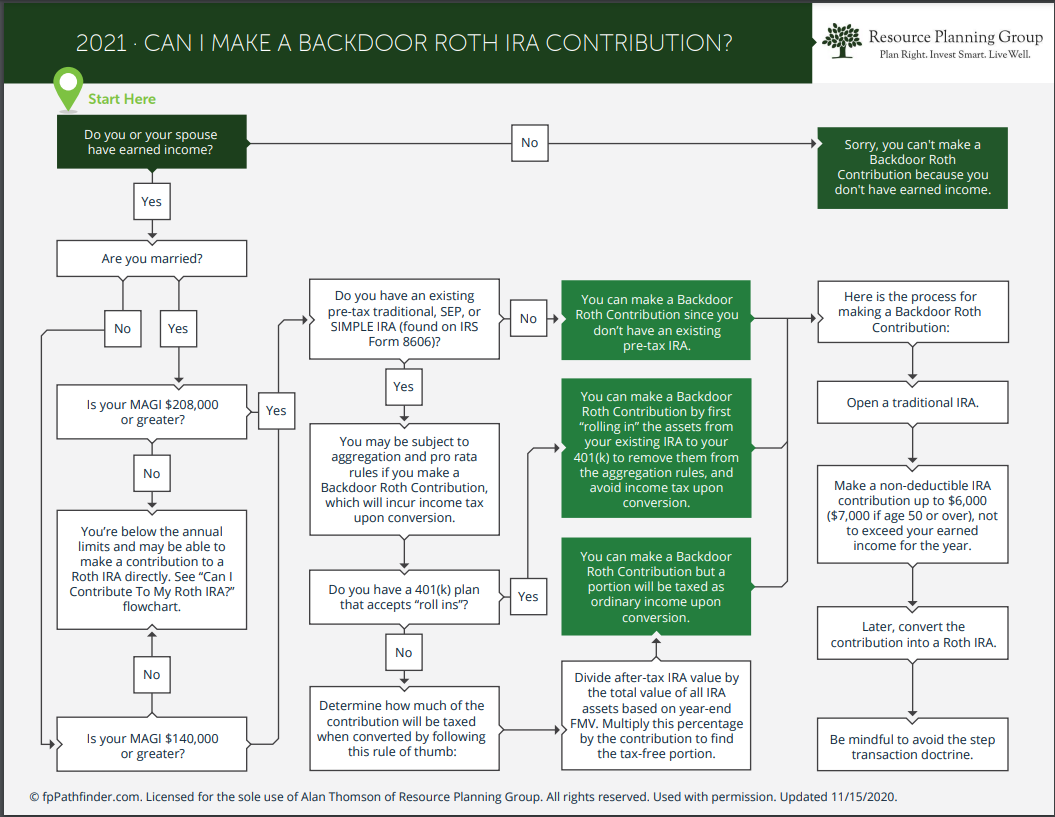

Web The deduction is meaningful with 5000 for single filers and 10000 for married couples filing jointly. But for many high earners they are unable to fund Roth. How To Reduce Taxable Income For High Income Earners In 2021.

Web tax deductions for high income earners 2019 Tuesday June 14 2022 Edit. The benefit of credits and exemptions is also reduced as income rises. Web The SECURE Act.

In Georgia however the deduction is only 2000 for. Web Whereas that deduction used to be unlimited its now capped at 10000 a year. Tax law changes in the Tax Cuts and Jobs Act affect almost everyone who itemized deductions on tax returns.

Web The good news is that with a combination of tax deductions tax credits and contribution strategies you can reduce your tax bill by reducing your taxable income. Contrast this to a worker earning 10200 per year. Web Gift and estate deductions help bring down taxable income but there is even more reason to take advantage of them now.

It would look like the following. Web Roth IRAs are incredibly attractive as they have tax-deferred growth and tax-free distributions in retirement. There would be a price elasticity of -06 for the base tier lowest income group -03 for Tier 1 -015 for Tier 2 and -005 for Tier 3 highest income group.

5 Outstanding Tax Strategies For High Income Earners

How To Reduce Your Taxable Income And Pay No Taxes Personal Capital

The Marriage Tax Penalty Post Tcja

U S Income Tax Policy Is Mostly About The 1 Justin Fox

How Do Taxes Affect Income Inequality Tax Policy Center

How The Tcja Tax Law Affects Your Personal Finances

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

Who Pays Income Taxes Tax Year 2019 Foundation National Taxpayers Union

The Status Of The Marriage Penalty An Update From The Tax Cuts And Jobs Act The Cpa Journal

Tax Reduction Strategies For High Income Earners 2022

Four Simple Scenarios That Show How Marginal Rates And Tax Breaks Affect What People Actually Pay

Summary Of The Latest Federal Income Tax Data Tax Foundation

Tax Reduction Strategies For High Income Earners 2022

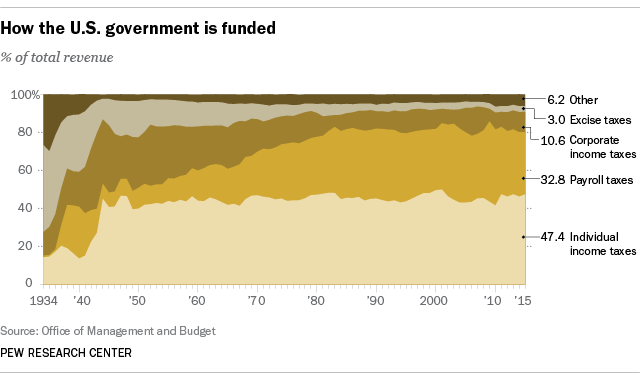

High Income Americans Pay Most Income Taxes But Enough To Be Fair Pew Research Center

Relieving The Medicare Surtax Strategies Assist High Income Earners Reduce Medicare Taxes And More University City Community Association Ucca

Who Benefits More From Tax Breaks High Or Low Income Earners

Opportunity For High Income Earners The Backdoor Roth Conversion Resource Planning Group

2020 Tax Changes For 1099 Independent Contractors Updated For 2020